The 2-Minute Rule for zero down chapter 7 Virginia

Some attorneys in Minnesota, and within the region, test in order to avoid these outcomes by submitting “no money down” and “small cash down” Chapter seven bankruptcy instances for customers under so-named bifurcated cost preparations.

Hedge funds, non-public fairness corporations and undertaking funds firms manage about $27 trillion in purchaser property for pension money, universities, charitable groups and rich men and women.

Absolutely. Many people today use credit card debt consolidation applications yearly to deal with their toughest credit challenges. It's a good idea to check out the status of any plan you're looking at: determine what other clientele say regarding their ordeals, see When the BBB has rated the business, and decide for yourself if their financial debt consolidation products and services are well worth your time and effort and (possibly) dollars.

If you’re guiding on payments or your car is truly worth under what you continue to owe on it, you could be superior off surrendering the vehicle. In the event you do that, you received’t really need to make any more monthly payments on it. Another choice is to pay for the lender the car’s current price in one lump sum.

The data on this Web page is just not intended to develop, and receipt or viewing of this information and facts isn't going to represent an attorney-client marriage.

You'll be able to gauge whether you've got sufficient disposable cash flow to tackle your debts with out a huge upfront payment by deciding the amount of money remaining more than just after covering navigate here these crucial prices.

You could question the courtroom to Permit you to shell out the fee in every month installments. You will need to pay back an Original minimum number of 25% of the filing charge inside 30 times of submitting the petition. After that, you spend every month installments of no below twenty five% of your filing rate.

Bankruptcy, Consumer Bankruptcy Some Practical Phrases A person or enterprise that owes income is recognized as a debtor. The individual or firm view website to whom the money is owed known as a creditor.

Chapter 7 bankruptcy could continue to be on your own credit score file for 10 decades; a Chapter 13 bankruptcy is customarily for taken out immediately after seven. Remarkably, bankruptcy can in fact increase your credit score score, nevertheless it can rarely erase all of anyone’s debts.

That on your own can be quite a big strain reduction. You furthermore go to my site may get a chance to do a money "reset" - Even though a unpleasant just one. That might assist you start receiving your financial lifestyle again if you want.

You don’t really need to seek the services of an attorney to file bankruptcy, but getting a legal professional with your facet to provide you with legal guidance and handle creditors’ cell phone calls may be handy.

Selecting an attorney for your bankruptcy may seem to be a luxury it is possible to’t manage. The excellent news is that most bankruptcy attorneys offer a free consultation for potential new shoppers.

Declaring bankruptcy need to linked here only be regarded as A final resort. Depending on the variety of bankruptcy you file, you might be necessary to offer your belongings, meet with (and response thoughts from) all of the persons which you owe dollars, Are living under a court docket-requested spending plan for up to five decades, suffer a large strike on the credit rating score, and discover it difficult to get a house, a vehicle, or a private financial loan for approximately a decade.

Do there is a choice regarding your lawyer's working experience? Extra encounter find out might mean slightly better Value, but usually a higher idea of the law.

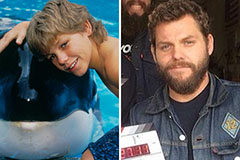

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!